Accounting software trends in 2026 reflect a shift toward smarter, more connected, and automated financial systems. As more and more organisations operate across multiple markets, modern accounting software facilitates operations while ensuring compliance and adaptability.

Top 5 accounting software trends: Overview

The most impactful accounting software trends revolve around AI-driven automation, cloud-based infrastructure, and integrated payment platforms. Modern solutions no longer operate as standalone ledgers; they connect payments, data, and reporting in a single environment for faster closes, improved accuracy, and stronger financial control across global operations.

| Accounting software trends | Description |

|---|---|

| AI and machine learning integration | Smarter automation, forecasting, and anomaly detection |

| Cloud-based accounting | Scalable infrastructure without upfront investment |

| Real-time data and analytics | Instant financial visibility |

| Integrated financial platforms | Unified systems for payments and accounting |

| Enhanced cybersecurity features | Advanced protection for financial data |

Trend 1: AI and machine learning integration

AI and machine learning are redefining accounting software by embedding intelligence directly into daily finance workflows. New tools are used to automatically classify transactions across multiple accounts and currencies, flag anomalies such as duplicate payments or unusual spending patterns, and monitor compliance with tax and internal control rules in real time. Further, machine learning models refine their logic based on historical posting behaviour, which drastically reduces rework during month-end close. Beyond automation, AI also supports rolling forecasts and scenario analysis to move from retrospective reporting to future-proof financial management.

Trend 2: Mobile accounting & remote access

Cloud-based accounting enables centralised financial management across entities, currencies, and locations without local infrastructure. In practice, cloud platforms provide finance teams with continuous access to live balances, transactions, and reports. Automatic regulatory and feature updates reduce dependency on internal IT resources, while integrations with banking, payroll, and expense systems eliminate manual data entries.

Trend 3: Real-time data and analytics

Real-time reporting is the new way organisations manage finances in fast-paced markets. Instead of relying on delayed reports, businesses can monitor cash flow, spending, and revenue instantly. This accounting software trend improves responsiveness and supports data-driven decisions. Advanced dashboards transform financial data into actionable insights, which helps teams identify risks and opportunities early.

Trend 4: Integrated financial platforms

Integrated platforms are becoming more popular as businesses seek unified financial ecosystems. Rather than managing separate tools, organisations benefit from central systems that connect payments, accounting, and modern reporting tools. amnis supports this shift by combining multi-currency accounts, real-time visibility and access, as well as automated finance management and reconciliation. Further integrations reduce manual work, improve data accuracy, and provide a single source of truth in one single platform.

Trend 5: Enhanced cybersecurity features

As financial data becomes increasingly digital, while stricter data protection regulations such as GDPR become a baseline requirement, providers are embedding advanced cybersecurity measures such as encryption, multi-factor authentication, and AI-powered threat monitoring. In the coming years, AI-powered security tools will further strengthen defenses to protect sensitive financial information, maintain stakeholder trust and adhere to new regulations.

Top 5 accounting automation trends: Overview

New accounting automation trends mainly focus on eliminating repetitive tasks. As automation is now a core capability rather than an optional add-on, it enables finance teams to work faster, reduce errors, and gain deeper insights with less manual effort.

| Accounting automation trends | Description |

|---|---|

| Robotic Process Automation (RPA) | Automates repetitive accounting tasks |

| Mobile accounting & remote access | Financial management on the go |

| Automated expense management | Faster expense tracking and approval |

| Intelligent invoice processing | AI-powered invoice capture |

| Predictive financial analytics | Forward-looking financial insights |

Trend 1: Robotic Process Automation (RPA)

Robotic Process Automation (RPA) describes the use of software robots to replicate rule-based human actions across digital systems. Within accounting, RPA is widely used to handle high-volume, repetitive tasks including bank reconciliations, data transfers between systems, and standard report generation. By executing predefined workflows consistently, RPA reduces manual errors and processing time, while accelerating month-end and year-end close. As adoption increases, RPA is becoming a standard capability in high-performing accounting departments.

Trend 2: Mobile accounting & remote access

With over 70% of professionals worldwide relying on smartphones for work tasks, mobile functionality is rapidly becoming an important accounting automation trend. Secure mobile access allows finance teams to review transactions, upload receipts, approve payments, and monitor spending in real time without being tied to a laptop or office. Meanwhile, finance managers gain real-time visibility into cash flow and budgets on the go.

Trend 3: Automated expense management

Automated expense management solutions are transforming how businesses control spending. Employees submit expenses digitally, while systems automatically categorise, validate, and route them for approval. This accounting automation trend reduces processing time and ensures compliance with internal policies, while advanced reporting provides finance teams with granular insights, such as department-level spending trends, vendor analysis, and real-time budget utilisation.

Trend 4: Intelligent invoice processing

Technologies such as optical character recognition (OCR) and natural language processing (NLP) automatically capture invoice details including vendor information, amounts, and due dates from screenshots, PDFs, scanned documents, or emails. Automated workflows then route invoices for approval and verify them against purchase orders. amnis takes mobile accounting further with features such as AI-powered receipt categorisation, tagging, and consolidated account visibility.

Trend 5: Predictive financial analytics

Predictive financial analytics uses historical transaction data, cash flow, and external market indicators to forecast future financial performance. Modern systems can identify potential liquidity shortages, predict late payments from customers, and model the financial impact of different budgeting scenarios. By highlighting trends and risks before they even occur, predictive analytics enables finance teams to optimise working capital, plan investments, and make informed strategic decisions rather than relying solely on historical reports.

Empower your accounting department with amnis

With amnis, organisations can centralise finance management, automate approval workflows, and use Expense AI to accurately capture, classify, and process receipts and invoices. The amnis ecosystem connects expenses, payments, and invoices with automated reconciliation, accounting-ready exports, and real-time reporting — giving teams full financial visibility with minimal manual effort.

-

- Expense AI & automated capture: Capture receipts on the go while AI automatically extracts data, assigns categories, cost centers, VAT rates, and matches expenses to transactions

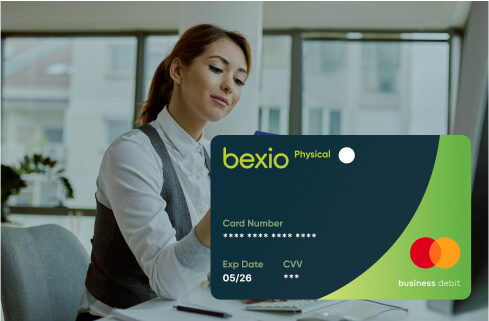

- Smart business debit cards: Support teams and temporary projects with adjustable limits, rules, and real-time transaction visibility

- Automated reconciliation: Card transactions, receipts, and invoices are automatically matched and reconciled

- Approval workflows & reminders: Define approval flows and send one-click reminders to complete missing expense data

- Automated, structured reports: Accounting-ready exports and scheduled reports reduce manual bookkeeping work

- Smart integrations: Extended accounting and expense capabilities via bexio, Kontera (pre-accounting), Edi (expense management), and more