Companies that often transfer money to the US or receive US dollars usually open a foreign dollar currency account with their bank in order to avoid expensive foreign exchange fees. In this article we go one step further und show how you can avoid high transaction costs like SWIFT with a local business account.

What is a foreign currency account?

Companies open their foreign currency accounts usually at their house bank to be able to handle transactions in other currencies. It is usually not possible to hold multiple currencies in the standard business account at the local house bank. This means that in order to receive or send foreign currencies, they are first converted, which leads to high exchange fees.

When opening a foreign dollar currency account at the bank, you receive an own account number and therefore pay the bank’s account maintenance fees. At most banks, the international dollar account is held as a sub-account, meaning that separate debit and credit cards can’t be issued.

Foreign dollar currency account: Advantages and disadvantages

A foreign USD account offers many advantages for companies that frequently do business abroad: The money no longer has to be converted at expensive foreign exchange rates for incoming or outgoing transfers, which can become very costly, especially for companies that carry out many transactions.

A foreign currency account may solve the problem of conversion (fx) fees, but the transaction costs for foreign transfers remain. Normally, SWIFT is used for these transfers. The SWIFT-system facilitates the transfer of money between international banks. The problem is that the money is often sent via several intermediary banks if there is no direct business relationship between the sender and recipient bank. Thus, sometimes up to 5 banks are involved in a single transaction. This is also reflected in the costs: on average, SWIFT fees range between 3-5% of the transferred amount.

Unfortunately, a foreign dollar currency account with your own house bank cannot avoid these transaction costs. In the following sections we go into more detail on alternatives to avoid not only the conversion but also the SWIFT fees.

For whom is a USD foreign currency account suitable?

Non-US companies that need a business bank account in the USA switch to modern payment platforms to send, receive, or hold US dollars, especially when operating internationally.

-

- Global businesses: Companies that invoice in USD or have suppliers, partners, or customers in the United States benefit from reduced conversion costs and smoother cross-border payments.

- E-commerce businesses: Online sellers dealing with American customers or marketplaces (Amazon, Shopify, etc.) can receive USD payments without forced conversions.

- Freelancers & service providers: Professionals working with U.S. clients can store and manage USD payments conveniently and avoid unnecessary exchange fees.

- Importers & exporters: Companies purchasing goods in USD or selling into USD-dominated markets use a dollar currency account to reduce FX exposure and hedge currency risk.

The best choice: a local dollar currency account

As local dollar accounts are only available to US-based companies, businesses outside the US are looking for international dollar accounts to leave SWIFT and gain access to the ACH network.

Why not simply open a foreign currency account in your home country? While a foreign dollar currency account at a local bank certainly has its merits when it comes to avoiding expensive exchange fees, the real problem remains: Companies still have to pay expensive SWIFT fees for foreign transfers. These are incurred by both the sender and the recipient, depending on the chosen expense allocation. Therefore, businesses that make foreign transfers several times a year should look for cost-effective alternatives: this is where local payment options become relevant.

If you want to transfer within the EU using SEPA, you need a European Euro account. If you seek to make use of ACH in the US, you also need a local US account accordingly. What is the advantage of these networks? The processing fees are extremely low, so you will be charged only a fraction of the SWIFT costs. In addition, the processing time is also much shorter. In the following section, we will go into more detail on how European companies can use the ACH network without having to open a USD account locally in the US.

Open a dollar currency account and gain access to ACH with amnis

amnis enables companies around the world to open an international dollar account to gain access to the ACH network. For local incoming payments in USD, businesses receive a USD account number in the name of their company. Even better: With amnis, companies gain access to free, local payments in the US, UK, CH and EU as well as multi-currency debit cards – all in one single platform.

-

- Gain access to ACH and other payment routes

- Free, local payments in the UK, US, CH & EU

- Receive, hold and send payments in over 20 countries

- If local payments are not possible, SWIFT is available in over 200 countries

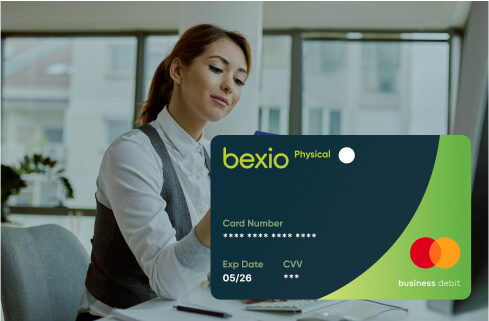

- Provide your staff with virtual and physical business debit cards

- Card FX rates at 0%. Learn how to get an amnis business debit card

Open your free amnis demo account now

Open a business account and save money right away: amnis enables companies to benefit from the most favourable payment options around the world. With the multi-currency account, you get all the tools to save money immediately and optimise your international money transfers. Open an amnis demo account now, completely non-binding:

FAQs

Whether you’re exploring USD accounts for global payments, FX strategy, or smoother operations with US partners, here are the most common questions businesses ask — and the answers that help you choose the right setup.

No. A dollar currency account lets you hold and transact in USD, but it is not necessarily located in the US. An international dollar account gives you US account details for ACH but is opened digitally without requiring a US entity or physical bank visit.